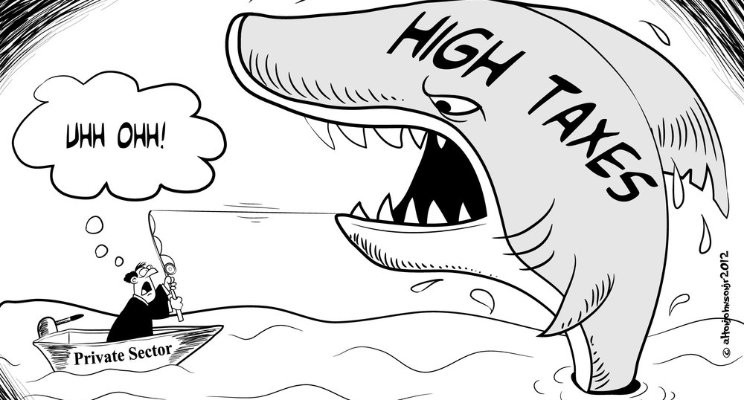

28 Mar High 2016 Taxes? – Don’t Let Your Business Make The Same Mistake in 2017!

As the 2016 tax filing deadline looms ever closer, more calls come in about helping to reduce business owner’s 2016 taxes. Sadly, in most cases, it is too late to do anything about 2016. Qualified retirement plans must have been established by December 31st of 2016 to receive that year’s tax deductions.

A business owner can still start a personal IRA or SEP plan for his business before he files his 2016 taxes – but these arrangements provide little tax relief when compared to the larger tax deductions available in profit sharing/401(k), defined benefit, 412e(3), and cash balance plans. These designs can also provide the owner with a much larger share of the plan contribution. We call that a win-win.

As a small business owner myself, having a plan that is designed for me and my retirement goals while accomplishing my business goals is wonderful. There are a few things I learned as this process was implemented in my business that might be useful for you whether you have a plan or not.

First, a little history. The Pension Protection Act of 2006 eliminated the “sunset” provisions of EGTRRA making permanent the many pension provisions designed to encourage small businesses and professionals to establish qualified plans. Increased benefit and contribution limits, both pretax and Roth deferrals, tax credits for new plans, and the new higher deduction limits for companion DB and DC plans – these and other changes that make a qualified plan more attractive than ever in the small business marketplace.

Yet many small businesses aren’t aware of the advantages of qualified plans and how they can be designed to favor owners. It’s estimated that over two thirds of small businesses do not have a qualified plan – and many with plans are not satisfied with the benefits provided to owners and other key employees.

Now is the time for business owners to see how a qualified retirement plan can not only provide for their retirement – but also reduce their 2017 and future tax bills!

Allow me to help avoid any misunderstanding, a 401(k) plan is a 401(k) plan is a 401(k) plan. There is no fundamental difference between any one provider’s 401(k) plan versus another in terms of how they work. They are all going to feature employee salary deferral contributions and some form or another of employer contributions to the plan. Distributions are distributions. Nearly 100% of participants take their money out of the plan at retirement and roll it to an IRA. What does matter is whether the plan design meets with the employer’s goals and objectives. Having my plan match both my goals and objectives was key. I didn’t have a qualified or non-qualified plan when I started. I felt like it was for companies much bigger than my own, I was concerned with the costs and I wasn’t sure of where I could go to get professional; honest support.

What many of us (Business Owners, HR Managers, and Benefit Managers) don’t realize is that it is VERY affordable to get a custom plan to fit our business needs in the small business sector.

When I was researching my own business retirement plan I talked with companies and individuals who had plans set up. Many of them complained about the arduous process to get it accomplished. Some mentioned how they weren’t happy with their current plan because they didn’t receive feedback, or they had to do their own tax papers for the plan and a few were concerned with feeling like they were just a number to their provider. It made me feel like when I went to the doctor and received a diagnosis that I had a Thyroid Disorder, the busy Doctor recommended surgery without much thought. I felt like that best thing for her and not me. So I did what most anyone would in my situation, I sought a 2nd opinion. The next doctor I met with had a different, more optimistic diagnosis. The result was I was able to get my thyroid under control and now don’t take any medicine. Why wouldn’t we do that with our own plans? Don’t you want to be sure about that? The best way to know is to verify what you have. Would you take the opinion of just one doctor after a critical recommendation or seek out a 2nd opinion?

Many plans cost a lot in fees to have a dedicated team of plan designers. It is unheard of in the small business sector for a custom designed retirement/pension plan, and yet that is exactly what small business owners need: a plan that is designed and created exactly to that business- for free. Not a cookie-cutter approach many firms might provide small businesses to “save money”. The benefit of a customized plan for small businesses is to maximize growth while minimizing a taxable footprint. Most vendors will refer the prospect business owner off to a consultant to create a plan design ($$$) or will offer plans with only limited options. I have also seen a lot of bad plan designs created by people who don’t do this for a living. It is so important for business owners to have confidence in the people working for them. That same confidence that the people handling their plan know what they’re doing.

You will probably find that a 401(k) plan offered through a broker will have relatively low investment related expenses but little by way of administrative support other than a 1-800 number for the employer to call if they/you need help with anything. It is rare that the same person answers the phone twice under such arrangements and the service is usually below par because the representative isn’t familiar with the client or their plan. The broker doesn’t know anything about the rules governing the operation of a 401(k) plan and isn’t going to hold employee meetings and help enroll participants in the plan either.

Small businesses need a plan where the employee meetings and enrollment assistance are very important services. Seek an assigned plan administration specialist to your plan you know exactly who to call whenever they have a question. Seek a representative who knows your business so when you call, you don’t have to worry about getting someone unfamiliar with you plan on the line every time you call.

Finally, get an investment product that is competitive with respect to the overall expenses and low administration fees. The benefits are that your costs are low while your investment growth is on point with the market.

Do your business a favor – Make sure what you have will keep your taxes and fees low while maximizing your business plan. All we need is a census to get started.

We owe it to ourselves to have the “right” plan for every situation. From innovative plan designs to IRS approved plan documents – competitive equity and fixed products to low cost and complete plan administration services – we can provide the qualified plan that meets retirement planning needs.

Contact Retirement Sales at 844-529-4488.

Disclaimer:

Neither Mike Dyal, American National Insurance Company nor its affiliates give legal or tax advice. Clients should contact their attorney or tax advisor for advice regarding their specific situation.

No Comments